Palantir Q3 2025 Earnings: U.S. Commercial Revenue Explodes 121% & Rule of 40 Hits 114%

- BC

- Nov 3, 2025

- 3 min read

Palantir Technologies just reported one of its strongest quarters ever — and the numbers highlight why many investors see it as one of the most powerful AI-driven software companies today.

For investors building long-term portfolios, this is a textbook example of a company scaling rapidly while also becoming more profitable — something extremely rare in the AI/software space.

Below is everything you need to know, including visuals from the official slide deck.

Q3 2025 Highlights at a Glance

(#1: Revenue Growth Chart)

Revenue: ~$1.18B, up 63% year-over-year

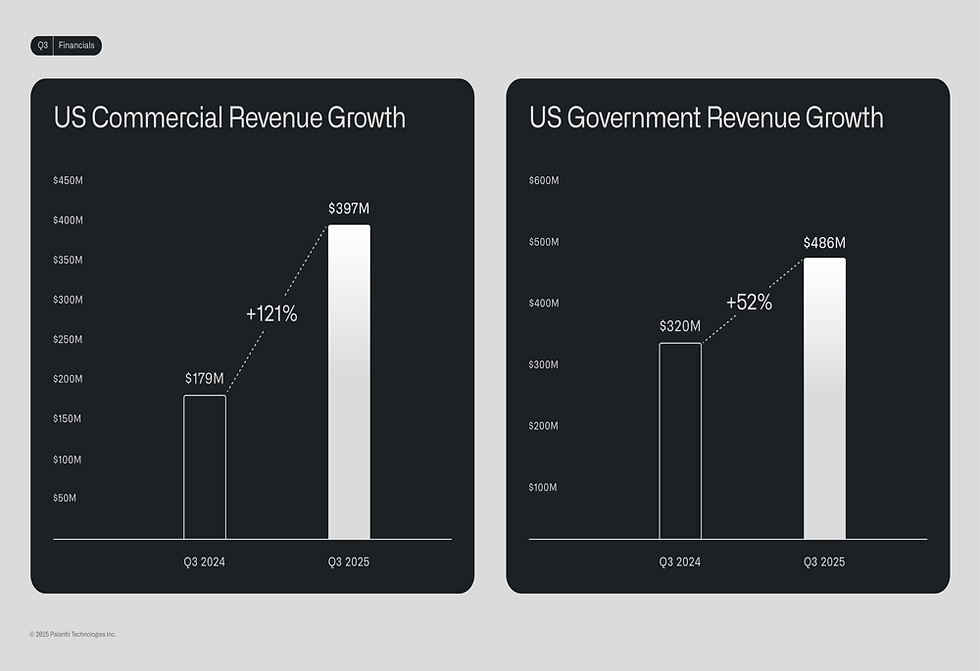

U.S. commercial revenue: $397M, up 121% YOY

Rule of 40 score: 114% (elite performance level)

204 deals ≥ $1M

53 deals ≥ $10M

Total contract value: ~$2.8B, up 151% YOY

Raised FY2025 guidance

Adjusted free cash flow: $1.9B–$2.1B expected

U.S. Commercial Revenue Is Now Palantir’s Growth Engine

(#2: U.S. Commercial Slide)

The most important part of this report:

Palantir is no longer just a government/defense software company.

U.S. commercial revenue — powered by Foundry and its AI Platform (AIP) — surged:

121% year-over-year

29% quarter-over-quarter

This shift matters because commercial clients offer:

Larger long-term upside

Higher repeatability

Faster adoption cycles

Less dependency on government budgets

For investors, understanding this transition is key. Palantir is proving it can scale across private-sector industries like healthcare, finance, supply chain, manufacturing, and energy.

Deals Are Getting Bigger — and More Frequent

(#3: Deal Breakdown)

This quarter, Palantir closed:

204 deals of $1M+

91 deals of $5M+

53 deals of $10M+

Total contract value: up 151% YOY.

Bigger deals = higher customer stickiness + better revenue visibility.

This is exactly what long-term investors want to see.

Rule of 40 Score Hits 114% — A Rare Achievement

(#4: Rule of 40 Chart)

The Rule of 40 is a metric used to judge software companies:

Revenue Growth % + Profit Margin % ≥ 40

Most companies struggle to hit even 40%.

Palantir delivered 114% — almost unheard of.

This signals:

High growth

High profitability

Strong operational efficiency

Massive leverage in their business model

For young investors, it’s the ultimate example of a company that’s scaling the right way.

Financial Outlook: Raised Guidance Shows Confidence

Palantir raised its full-year outlook:

FY2025 revenue: $4.396B–$4.400B

U.S. commercial revenue: $1.433B+, growing 104% YOY

Free cash flow: $1.9B–$2.1B

When a company raises guidance, it typically means:

Strong pipeline

High confidence in customer demand

Operational momentum

Visibility into future quarters

Why This Matters for Investors

1.Commercial scaling is the biggest turning point in Palantir’s history

This diversifies revenue away from government contracts and opens up massive market potential.

2.Profitability + growth = long-term compounding potential

AI companies often burn cash. Palantir prints cash.

Large enterprise clients rarely switch platforms — this creates sticky revenue.

4.Palantir is positioning itself as the operating system for enterprise AI

This is a winner-take-most market if they execute.

Risks Investors Should Watch

Even with strong results, Palantir still faces challenges:

AI competition from Microsoft, AWS, Google, Snowflake

Execution risk as they hyper-scale commercial adoption

Valuation remains elevated versus traditional software companies

Dependency on successful AIP rollout across industries

Investors should follow upcoming quarters closely to see if this growth rate is sustainable.

Final Takeaway: Palantir Just Delivered a Breakthrough Quarter

Between explosive U.S. commercial growth, elite profitability, massive contract wins, and raised guidance — Palantir delivered a near-perfect quarter.

For long-term investors, this is the type of company worth studying:

high growth, high margins, sticky customers, and a massive runway in enterprise AI.

Comments